Rare coins present a captivating combination of history, artistry, and the potential for financial gain. Delving into the nuances of coin investment can help answer key questions that often arise, such as how to assess a coin’s value, the factors that contribute to its long-term appreciation, and the risks involved.

Why Invest in Rare Coins?

Rare coins represent more than just monetary value. They are tangible assets that offer a unique combination, which can make rare coins a practical long-term investment. Over time, many rare coins have the potential for significant appreciation due to their scarcity and demand.

Two popular choices among rare coin collectors are coins from the Morgan Dollar series and pre-1933 Saint-Gaudens gold coins.

Morgan Silver Dollars

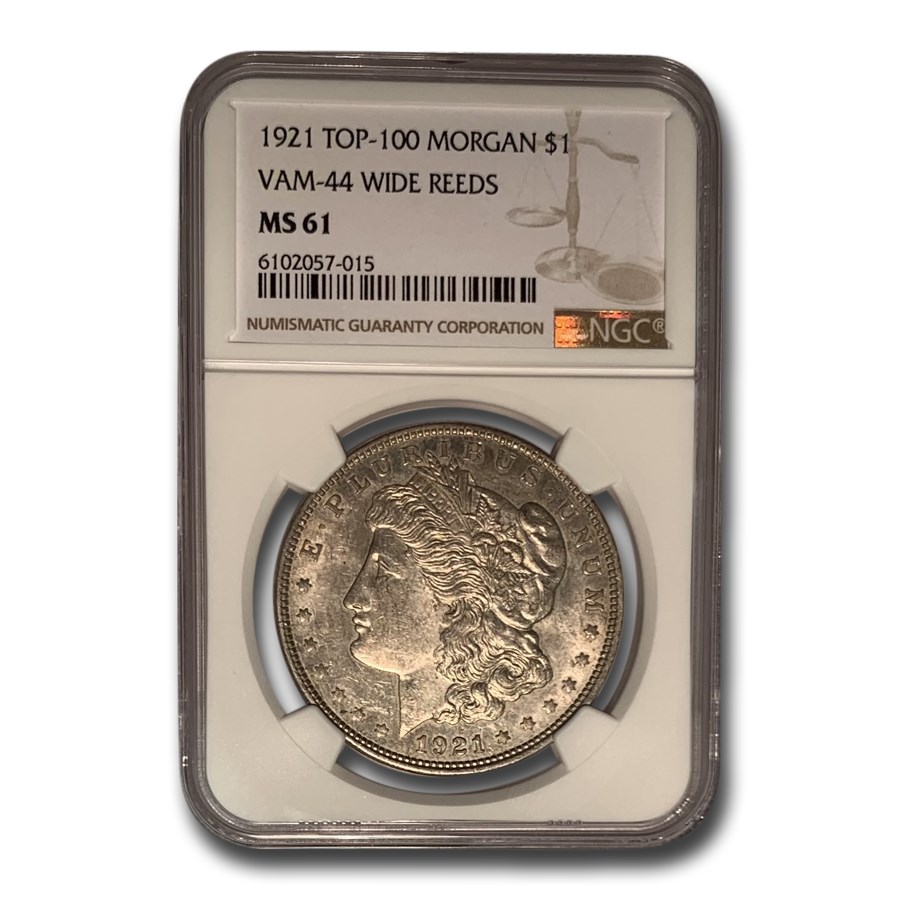

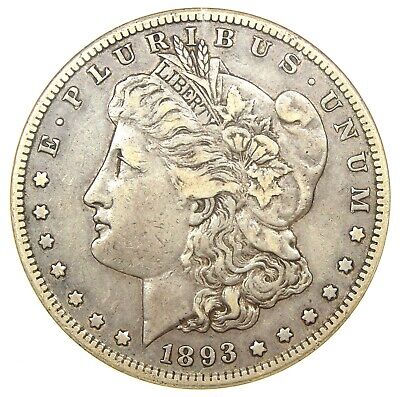

The Morgan Silver Dollar is an iconic American coin that was minted from 1878 to 1904 and again in 1921. Due to the long mintage history and historical significance, collecting Morgans is a popular hobby.

Collectible examples from this series include the 1893-S Morgan Dollar, one of the rarest with low mintage and high demand, as well as the 1889-CC Morgan Dollar from the Carson City Mint. These coins can command premium prices, particularly in higher grades and among low-mintage years.

Saint-Gaudens Double Eagles

The pre-1933 Saint-Gaudens Double Eagle, designed by Augustus Saint-Gaudens and first minted in 1907, is another highly sought-after collectible. Known for its stunning artistry, the Saint-Gaudens Double Eagle is widely regarded as one of the most beautiful American coins ever produced.

Collectible examples include the 1907 High Relief Saint-Gaudens and the 1927-D Double Eagle, both of which are rare and in high demand due to limited production or preservation. These coins hold substantial numismatic value and continue to appreciate over time.

Factors that Affect the Value of Rare Coins

Several key factors affect the value of rare coins, including scarcity, condition, and historical significance.

Scarcity is a primary driver of value; the fewer coins available from a particular series or year, the higher their worth. Collectors and investors often seek unique, limited, or hard-to-find pieces.

Condition is also crucial. Coins in higher grades are more desirable and valuable because they offer third-party verification. Professional grading services quantify the coin’s state, and even small differences in grade can significantly impact value.

Historical significance adds another layer of appeal, as coins tied to notable events, eras, or cultural moments often command premium prices. The narratives behind these coins make them more meaningful and sought after by collectors.

Together, these factors shape a coin’s market value, enhancing its appeal as both a collectible and a valuable investment.

Where to Start?

These iconic coins are popular choices for collectors, as they combine historical value, aesthetic appeal, and investment potential. Getting started with research and reputable resources can make the journey enjoyable and rewarding.

For Morgan Dollars and Saint-Gaudens coins, familiarize yourself with the different years, mint marks, and varieties. Notable resources include specialized books, online articles, and coin shows, where you can meet dealers and experts.

It’s best to buy from reputable dealers with a trustworthy reputation in the numismatic community. Certified dealers of the American Numismatic Association (ANA) can provide assurance that you’re buying genuine and fairly graded coins.

Certification from professional grading services like PCGS or NGC verify a coin’s condition and authenticity. Graded and authenticated coins also provide peace of mind.

Notable Books About Morgans and Saint-Gaudens Coins

- A Guide Book of Morgan Silver Dollars by Q. David Bowers: Often referred to as the “Red Book” for Morgan Dollars, this guide provides an in-depth look at Morgan Dollars, covering their history, minting, varieties, and valuations.

- The Morgan and Peace Dollar Textbook by Wayne Miller: This book covers both Morgan and Peace Dollars, including grading tips, key dates, and varieties, making it a good choice for collectors interested in both series.

- Saint-Gaudens Double Eagles: As Illustrated by the Phillip H. Morse Collection by Douglas Winter: This comprehensive book is an invaluable resource for Saint-Gaudens collectors, offering detailed insights into rare dates and varieties in the series.

- A Guide Book of Gold Eagle Coins: Liberty Head, Indian Head, and Saint-Gaudens by David W. Akers: This book explores the history and details of U.S. gold coins, including Saint-Gaudens Double Eagles, and provides information on key dates and values.

Risks Involved in Rare Coin Investment

As with any investment, rare coins come with their own unique risks that collectors and investors should be aware of.

One of the primary risks is market volatility. Coin values can fluctuate significantly based on broader economic conditions and shifts in collector interests. During economic downturns values may stabilize or even drop as collectors become less willing to spend. Conversely, economic booms can drive up prices due to higher demand.

Liquidity is also an important consideration, as selling rare coins at a desired price can depend on market timing. For extremely rare and valuable coins, finding the right buyer may take time.

Another considerable risk is the prevalence of counterfeit coins in the market that can be difficult to detect, especially for less experienced buyers. Counterfeiters often target high-value coins or popular series. This makes it important to buy from reputable dealers and invest in coins that are authenticated from trusted grading services.

How to Store and Insure a Rare Coins Collection?

Proper storage is essential for maintaining the condition and value of a coin collection. Protective holders or capsules can help shield coins from physical damage. These holders can be bought from hobby and coin stores, Amazon and eBay.

Additionally, ensuring your collection can provide peace of mind. Coin insurance helps protect against potential theft, loss, or accidental damage, ensuring that your investment is safeguarded.