In 2024, the Perth Mint, a prominent player in the global precious metals market, experienced a marked decline in bullion sales for gold and silver. These shifts offer insights into changing market dynamics, investment behaviors, and broader trends in precious metals. This article examines the Mint’s sales data, explores factors behind the decline, and discusses implications for investors.

Overview of World Coins and the Perth Mint’s Role

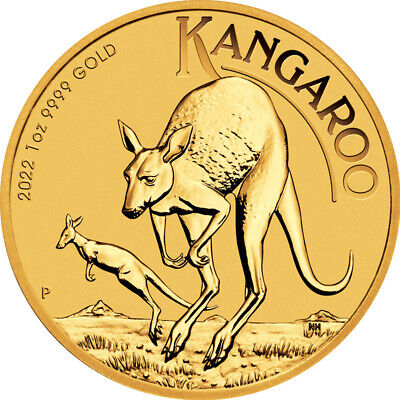

World coins have long been a cornerstone of the precious metals market, offering collectors and investors a diverse range of options. The Perth Mint, known for its Australian bullion products such as the Kangaroo and Lunar Series, is recognized for producing high-quality gold and silver coins.

These coins are valued both for their bullion content and their collectible appeal, making the Perth Mint a key player in the global market.

Gold Bullion Sales: A Significant Decline

The Perth Mint reported a sharp drop in gold bullion sales in 2024, continuing a downward trend from previous years. Total annual sales reached 391,606 ounces, representing significant declines compared to prior years:

- 41.2% decrease from 665,889 ounces in 2023.

- 64.9% decline from 1,116,969 ounces in 2022.

- 62.7% drop from 1,050,242 ounces in 2021.

Monthly Trends

December 2024 saw particularly weak gold sales, totaling 31,727 ounces—a 45.4% decrease from November and 12.6% lower than December 2023. These figures underscore the challenges the Mint faced in sustaining demand.

Factors Contributing to the Decline

- Market Volatility: Gold prices surged by 26.5% in 2024, but fluctuations may have deterred some buyers, particularly those focused on cost.

- Investor Behavior: With gold prices near record highs, many investors opted to sell existing holdings rather than buy new bullion products.

- Increased Competition: Growing activity in secondary markets and competition from other mints impacted the Perth Mint’s sales.

Silver Bullion Sales: A Modest Decline

Silver bullion sales at the Perth Mint fared better than gold but still experienced a year-over-year decline. The Mint sold 9,813,384 ounces of silver in 2024, reflecting:

- 34.1% drop from 14,896,564 ounces in 2023.

- 57.7% decrease from 23,176,142 ounces in 2022.

- 48.6% decline from 19,091,681 ounces in 2021.

Monthly Trends

In December 2024, silver sales reached 1,057,311 ounces, showing a 0.2% increase from November and a 55.2% rise compared to December 2023. This late-year recovery was largely attributed to the successful release of the 2025 Australian Kangaroo bullion series.

Factors Influencing Silver Sales

- Affordability: Silver’s lower price point compared to gold makes it accessible to a broader range of investors.

- Product Innovation: The introduction of new designs, such as the 2025 Kangaroo series, supported demand.

- Industrial Demand: While industrial applications for silver remained stable, investment demand fell short of offsetting declines.

Global Trends and the Secondary Market

The decline in bullion sales at the Perth Mint reflects global trends in the precious metals market. While gold and silver prices rose significantly in 2024, high prices discouraged some buyers. At the same time, activity in secondary markets increased, offering investors access to lower-premium products.

- Gold Price Trends: Gold prices surged by 26.5%, reaching multi-year highs.

- Silver Price Trends: Silver prices rose by 23.8%, driven by industrial demand and investment interest.

Investors increasingly turned to secondary markets, where older Perth Mint products, such as the Kangaroo and Koala coins, are available at lower premiums. This shift highlights the importance of cost efficiency in investment strategies.

New Perth Mint Bullion Product Releases

In 2024, the Perth Mint introduced several new bullion products, including:

- 2025 Australian Kangaroo Series: Strong reception for these coins, particularly the 1 oz gold and silver versions, contributed to late-year sales.

- Lunar Series III – Year of the Snake: This series attracted interest from collectors worldwide.

- Unique Designs: Coins like the Australian Brumby and Super Pit offered variety to investors and collectors.

Despite these innovations, the overall decline in sales indicates that new releases were insufficient to offset broader market challenges.

Perth Mint Monthly Sales Data (2024)

The following table summarizes monthly sales for gold and silver bullion at the Perth Mint:

| Month | Gold (ounces) | Silver (ounces) |

|---|---|---|

| January | 24,651 | 769,326 |

| February | 47,086 | 1,006,852 |

| March | 16,442 | 860,672 |

| April | 33,387 | 684,735 |

| May | 23,238 | 796,934 |

| June | 22,520 | 491,946 |

| July | 25,457 | 939,473 |

| August | 25,884 | 647,382 |

| September | 53,143 | 963,198 |

| October | 29,935 | 539,898 |

| November | 58,136 | 1,055,657 |

| December | 31,727 | 1,057,311 |

Opportunities for Investors

The Secondary Market

The decline in sales highlights potential opportunities in the secondary market. Investors can find Perth Mint products, such as older Kangaroo and Koala coins, at competitive premiums. These coins remain highly recognized and offer strong liquidity.

Diversification

Gold and silver continue to provide portfolio diversification benefits. Investors should consider a mix of modern bullion and secondary market options to optimize cost efficiency and potential returns.

Conclusion

The Perth Mint’s 2024 bullion sales underscore the evolving dynamics of the precious metals market. Declines in gold and silver sales reflect shifting investor preferences, rising competition from secondary markets, and the impact of higher prices. Despite these challenges, the Mint’s reputation for quality ensures its continued relevance.

For investors, these trends emphasize the importance of strategic decision-making. By exploring both modern bullion and secondary market opportunities, collectors and investors can navigate these changes effectively and preserve their wealth through tangible assets.