TL;DR: Whitman’s Red Book Series is dropping three timely volumes this fall—United States Type Coins (4th Ed.), Private & Pioneer Gold Coins of the United States, and Flying Eagle & Indian Head Cents (4th Ed.)—with current pricing, grading guidance, and standardized GSID catalog numbers. For bullion buyers and coin investors, these references can tighten your bids, help you spot value in scarce series, and reduce the risk of overpaying in today’s data-rich but noisy market.

Why the Whitman Red Book new titles 2025 matter right now

Whether you stack ounces or chase keys, your edge often comes from better reference data—especially when premiums are volatile and inventory rotates fast. Whitman’s Red Book line has anchored U.S. numismatics since 1946, evolving into a suite that blends historical context with grade-by-grade retail pricing and now the Greysheet Identification (GSID)system for consistent cataloging across Whitman products. The latest 6×9 redesign expands images, values, and readability, carrying over to these fall releases.

From an investor’s lens, the three new/updated volumes map neatly onto core opportunities:

- Type-set collecting (diversified exposure across U.S. coinage with tight budget control)

- Pioneer/territorial gold (high-pedigree assets with thin populations and provenance premium)

- Small cents (popular, research-heavy series where die varieties and color designations drive price)

Each area intersects bullion and numismatics differently—but all reward discipline, grading literacy, and provenance awareness.

The fall lineup at a glance

- United States Type Coins, 4th Edition (early September): revised values in up to nine grades, updated images, and collecting roadmaps spanning 1792 half dimes to American Innovation dollars. Senior editor Jeff Garrettcalls type collecting “one of the most rewarding and accessible ways to explore American numismatics.”

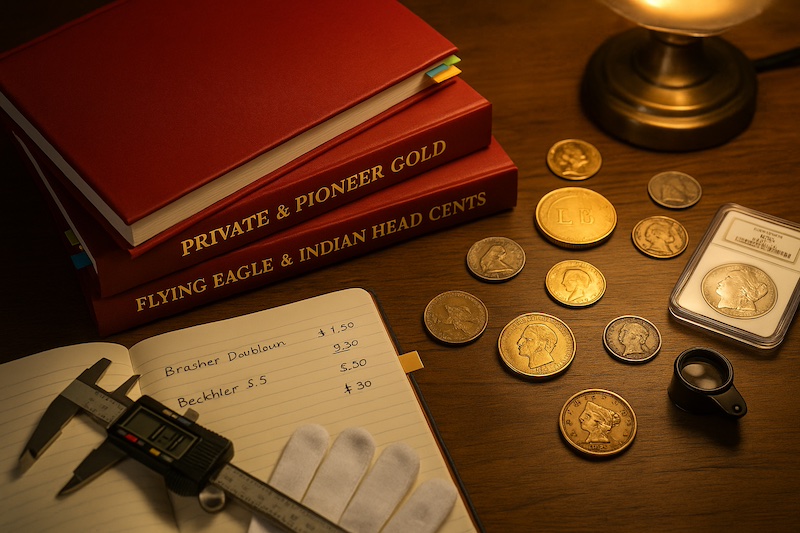

- Private & Pioneer Gold Coins of the United States (mid-September): a first in the series, authored by Donald H. Kagin, Ph.D. and David J. McCarthy—from Brasher doubloons to Bechtler issues, fractional gold, and the big $50 “slugs.” Includes historical essays, rarity guidance, and market values.

- Flying Eagle & Indian Head Cents, 4th Edition (October): expanded coverage by Richard Snow, with mintages, grading, die varieties, counterfeit detection, and Brown/Red-Brown/Red price splits—critical for valuation.

Whitman’s leadership frames the updates as part of a broader push—Red Book Quarterly (CPG retail) alignment, podcast and digital initiatives, and standardized GSID numbers—to keep references both trusted and current.

How these books translate into real investor advantages

1) United States Type Coins (4th Ed.): precise exposure without overpaying

Type-set collecting lets you build a broad, visually rich portfolio while concentrating dollars in the best grade you can afford for each type. That approach reduces FOMO on long date-and-mint runs and makes it easier to sell into broad demand later. Greysheet’s guidance on type sets underscores the strategy’s budget efficiency and flexibility.

Use-case: Instead of chasing every Morgan by mintmark, a type buyer might secure one superb Type 1 Double Eagle, a sharply struck Seated Liberty example, and an attractive Barber—maximizing eye appeal per dollar and targeting coins with wider resale audiences.

Expert note: Garrett’s emphasis on storytelling by type—“each coin tells a story”—aligns with how premiums accrue to design milestones and short-lived subtypes (think early copper or transitional reliefs).

2) Private & Pioneer Gold: where provenance can outrun melt

Pioneer and territorial gold sits at the intersection of history, rarity, and bullion. The Kagin–McCarthy volume documents coins outside federal authority (1786–1862), including the Brasher doubloon, Templeton Reid, and Bechtlerseries—material that commands serious premiums when authentic, problem-free, and well-pedigreed.

Why it matters to bullion buyers: In tight markets, some investors migrate from generic ounces to historic gold with capped populations. But the risk of misattribution or counterfeit rises in thin categories. A modern, photo-rich, GSID-aligned reference reduces error risk and helps you price rarity and condition—not just metal content.

Market context: Kagin and McCarthy’s prior scholarship and the 2023 deluxe presentation helped standardize narratives and rarity scales—useful for cross-checking dealer claims.

3) Flying Eagle & Indian Head Cents (4th Ed.): variety knowledge = pricing power

Small cents are entry-friendly yet expert-demanding: surfaces, color designations (BN/RB/RD), and die varieties(including key Snow numbers in the literature) can swing prices dramatically. A crisp, grade-tiered guide with counterfeit diagnostics is invaluable when evaluating raw lots, older holders, or online auctions.

Tip: Treat color designations like a multiplier on grade—an attractive, original RD example in MS65 can outpace a technically similar RB. Know the diagnostics before you hit “bid.”

What’s new under the hood: GSID numbers, CPG retail, and the 6×9 format

Recent Red Book updates lean into data standardization and usability:

- GSID catalog numbers (Greysheet Identification) unify coin IDs across Whitman books and digital properties, easing inventory tracking and cross-referencing.

- CPG Retail (Red Book Quarterly) pricing layers in grade-by-grade values that hobbyists recognize and dealers respect—especially for modern issues with active secondary markets.

- A larger 6×9 trim improves charts, photos, and layout across the line (including 2026 core Red Book), with thousands of images and tens of thousands of market values.

Bottom line: Better structure + bigger visuals = faster decisions at a show table.

Balanced perspectives: books vs. online resources

| Consideration | Red Book Series advantages | Online-only approach |

|---|---|---|

| Authority & curation | Peer-reviewed, edited volumes; standardized GSID; consistent CPG pricing; stable historical context. | Fast-moving chatter can surface new finds, but quality varies; at risk of partial or conflicting info. |

| Speed at the table | One reference per specialty with images and values “in reach.” | Requires multiple tabs, bandwidth, and site logins at shows. |

| Depth of niche content | Focused titles (e.g., pioneer gold, type coins) with curated diagnostics and pedigrees. | Depth depends on forum posts or dealer PDFs; may lack consistent grading language. |

| Price discovery | Grade-by-grade retail baselines to frame negotiations. | Auction comps useful but vary with venue, fees, and seasonality; context may be thin. |

Balanced view: Use both. Let the books establish the framework (taxonomy, diagnostics, baseline values), then validate auction comps and dealer asks online.

Smart ways bullion and coin investors can use the new titles

- Set a buying rubric for shows. For each target type or variety, define acceptable grades, surfaces, and budget caps using the book’s value tables and diagnostics.

- Screen for “story premiums.” In pioneer gold, pay for documented provenance and problem-free surfaces—and pass on cleaned, plugged, or questionable pieces. The book’s photo plates and rarity notes help.

- Improve your sell discipline. Red Book grade ladders help you set ask prices that reflect realistic retail—especially for small cents where BN/RB/RD spreads are wide.

- Use GSID to unify inventory. Tag slabs, flips, and spreadsheets with GSID so your collection maps cleanly to multiple Whitman/Greysheet resources and to dealer lists.

Expert voices (quotes & paraphrases)

- Jeff Garrett, Senior Editor (paraphrased/quoted): “Type-coin collecting is one of the most rewarding and accessible ways to explore American numismatics… Each coin tells a story.” His framing underscores that design milestones and scarcity—not long date runs—can be the most efficient path to quality.

- Whitman leadership (paraphrased): The Red Book refresh aims to standardize content across titles, expand market data, and improve access with digital formats and podcasts—keeping references current as the hobby evolves.

Historical context: why these topics resonate in 2025

- Type collecting dates back to early hobby handbooks and gained modern traction as a budget-savvy path to breadth and beauty—particularly relevant when premiums fluctuate and buyers seek quality over quantity.

- Pioneer/territorial gold mirrors the gold-rush era’s entrepreneurial minting—private solutions to local liquidity shortfalls. Today, these coins embody American financial ingenuity, appealing to hard-asset investors who want history plus metal.

- Small cents remain a gateway for new collectors—and a mastery challenge for veterans—where die states, repunched dates, and color separate commodity from trophy.

Risks and safeguards (YMYL-aware)

- Data drift: Prices move. Cross-check CPG/Red Book values with recent auction comps for thin markets.

- Counterfeits & altered coins: Especially in high-premium niches (pioneer gold, key small cents). Buy certifiedwhen uncertain, and use the books’ diagnostics before committing.

- Over-grading risk: Don’t pay PF/UNC money for AU sliders. Use photo plates and check luster breaks and high-point rub carefully.

Quick comparison: which title is “for you”?

| Your goal | Best match | Why |

|---|---|---|

| Diversify with high eye-appeal per dollar | United States Type Coins (4th Ed.) | Broaden exposure with one excellent example per design; easier resale breadth. |

| Add historical gold with scarcity | Private & Pioneer Gold Coins | Provenance-rich coins where knowledge edge matters; robust photo plates and rarity guidance. |

| Hunt varieties and optimize grading outcomes | Flying Eagle & Indian Head Cents (4th Ed.) | Variety-heavy series; color designations and diagnostics materially impact price. |

FAQs

Are these books only for advanced collectors?

No. The Type Coins volume is beginner-friendly yet deep enough for veterans. The Small Cents and Pioneer Goldbooks benefit from some grading familiarity but are written to teach as you go.

What’s the practical benefit of GSID numbers?

They synchronize coin IDs across Whitman books, Red Book Quarterly/CPG pricing, and dealer/distributor systems—reducing cataloging confusion and speeding comparisons.

How current are the prices?

Whitman integrates CPG retail and periodic updates. For hot markets or thinly traded rarities, also check recent auction results.

Will these titles be available digitally?

Whitman’s push includes digital editions and podcasts alongside print, improving access and updates. Check Whitman and major retailers for formats.

Conclusion: a timely toolkit for confident buying and selling

The Whitman Red Book new titles 2025 are more than shelf candy. They’re structured, reputable decision tools at a moment when collectors face both information overload and fast-moving markets. If you’re a bullion-first investor, they’ll help you identify where history justifies a premium—and where it doesn’t. If you’re a coin collector, they’ll refine your eye, sharpen your grading calls, and align your inventory with standardized IDs and pricing. Add them to your bench, and turn the next show into a confident, data-driven hunt.