Investors have long turned to precious metals to diversify their portfolios, hedge against inflation, and preserve wealth. Gold and silver are the most popular choices among these metals, each offering unique benefits and risks. Deciding which suits your portfolio requires understanding their differences, market dynamics, and historical performance. In this article, we’ll explore the key factors that can help you decide between gold and silver.

Understanding the Gold-to-Silver Ratio

The gold-to-silver ratio is a metric investors use to determine the relative value of these two precious metals. It indicates how many ounces of silver it takes to purchase one ounce of gold. Historically, this ratio has fluctuated significantly, providing insights into the market dynamics of both metals.

As of the most recent data, the gold-to-silver ratio hovers around 70 to 80, meaning it takes 70 to 80 ounces of silver to equal the value of one ounce of gold. Various factors, including supply and demand dynamics, geopolitical events, and economic conditions, can influence this ratio. Investors often use this ratio to make strategic decisions, such as when to buy or sell one metal relative to the other.

For more detailed information about the gold-to-silver ratio, see Investopedia’s explanation.

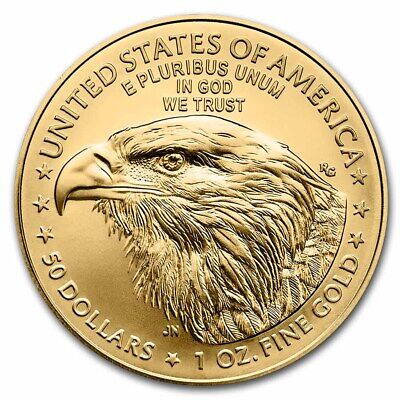

Gold: A Safe Haven Asset

Gold has long been considered a safe haven, particularly during economic uncertainty. Its ability to retain value over time makes it popular among investors looking to preserve their wealth. Some of the key characteristics of gold include:

- Stability: Gold is known for its price stability compared to other commodities, making it less volatile and a preferred choice during market downturns.

- Inflation Hedge: Gold has historically been an effective hedge against inflation, maintaining its purchasing power even as fiat currencies lose value.

- Global Acceptance: As a universally recognized store of value, gold is widely accepted across different cultures and economies.

However, gold investing also comes with challenges, such as high storage costs and lack of yield. Consider reading the World Gold Council article for more insights into gold as an investment.

Silver: The Versatile Metal

Silver, while less universally recognized than gold, offers its own set of advantages that attract investors. Known for its industrial applications, silver’s demand is influenced by both investment and industrial needs. Critical characteristics of silver include:

- Industrial Demand: Silver is used in various industries, including electronics, solar energy, and medical applications, which can drive its demand and price.

- Affordability: Silver’s lower price per ounce than gold makes it more accessible to a broader range of investors.

- Volatility: Silver tends to be more volatile than gold, offering higher potential returns and greater risk.

Silver’s dual role as an investment asset and an industrial commodity makes it a unique addition to any portfolio. For more information on silver’s uses and market behavior, visit The Silver Institute.

Critical Considerations for Your Portfolio

When choosing between gold and silver for your investment portfolio, several factors should be taken into account:

Risk Tolerance and Investment Goals

Your risk tolerance and investment goals will significantly influence your choice. Gold’s stability suits conservative investors looking to hedge against economic uncertainty. In contrast, silver’s volatility can appeal to those seeking higher potential returns and willing to accept more significant risks.

Market Conditions and Economic Indicators

Monitoring market conditions and economic indicators can help inform your decision. During periods of economic growth, industrial demand for silver may increase, potentially boosting its price. Conversely, gold’s safe haven status may make it a more attractive option in economic instability.

Portfolio Diversification

Diversification is a critical strategy in portfolio management. Including gold and silver can help balance risk and reward, leveraging the strengths of each metal. The gold-to-silver ratio can also guide your allocation strategy, allowing you to adjust your holdings based on market conditions.

Conclusion

Gold and silver offer unique benefits and risks, making them valuable additions to a diversified investment portfolio. By understanding the gold-to-silver ratio, considering your risk tolerance, and staying informed about market conditions, you can make a well-informed decision that aligns with your investment goals. Whether you choose gold, silver, or a combination, these precious metals can be crucial in preserving and growing your wealth.

To read more about investing in precious metals, you can explore Kitco’s comprehensive resources.