Investing in precious metals offers a reliable way to diversify your portfolio and preserve wealth over time. One of the most straightforward ways to do this is through bullion bars. In this post, we’ll cover the basics: bullion bars, why they are considered a store of value, and which bars are most popular among modern investors.

What Are Bullion Bars?

Bullion bars are solid bars of precious metals, typically gold, silver, platinum, or palladium. They are primarily valued based on their weight and purity rather than a face value, as seen with coins.

Many mints issue gold bars in various sizes, from as small as 1 gram to as large as 1 kilogram or even more. Popular sizes include 1 oz, 10 oz, and 1 kg bars for investment purposes.

Produced by established refineries or mints, each bullion bar is stamped with weight, purity, and manufacturer details, making it easy for investors to verify its authenticity.

Reliable Store of Value and Wealth

Bullion bars are an excellent store of value because their worth is tied directly to the current market price of the precious metal they contain.

Precious metals, especially gold and silver, have shown long-term stability and value retention, making them a reliable safeguard against inflation and economic uncertainty. By holding bullion bars, investors can preserve wealth over time, as metals often appreciate or hold their value when currency values decline.

Why Is Bullion Used as a Store of Value and Wealth?

Bullion has been a trusted way to store value for centuries because of its durability, rarity, and universal recognition.

Metals like gold and silver are tangible assets and resistant to corrosion, making them enduring stores of wealth.

The limited supply of these metals ensures they maintain intrinsic value, and during economic instability, investors often turn to bullion as a safe-haven asset.

Its independence from government and financial institutions makes bullion especially appealing for long-term wealth preservation, with its value remaining stable even through economic disruptions.

Top 5 Modern Bullion Investment Bars

Here are some of the most popular bullion bars chosen by investors worldwide:

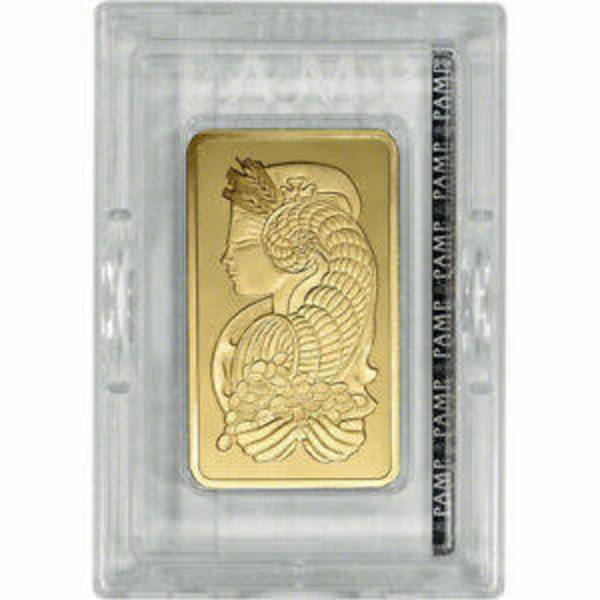

The PAMP Suisse Gold Bar is a well-regarded choice among investors for its exceptional quality and detailed security features.

Manufactured in Switzerland, it features the iconic “Lady Fortuna” design, a symbol of wealth and fortune, which has become synonymous with PAMP’s reputation for high standards. Its worldwide recognition and trusted quality make it a top choice for gold investors globally.

The Credit Suisse Gold Bar is produced by Credit Suisse, one of the world’s oldest financial institutions. Known for its purity and quality, this bar bears the prestigious branding of Credit Suisse, giving it a strong reputation for reliability.

Investors value it for its globally recognized name and assurance of authenticity, making it a dependable asset in any investment portfolio.

The Royal Canadian Mint Silver Bar, particularly the 10 oz size, is one of the most popular silver bullion bars.

The Royal Canadian Mint’s reputation for quality and purity extends to these bars, which are highly trusted in the market. This bar’s association with the respected Canadian Mint and its high standards make it an excellent choice for silver investors.

The Perth Mint Gold Bar is produced by Australia’s esteemed Perth Mint, renowned for its exceptional craftsmanship.

Each bar is stamped with the Perth Mint’s iconic swan logo and includes unique security features, enhancing its appeal to investors. Known for quality and authenticity, Perth Mint bars are widely recognized and respected worldwide, providing assurance to gold investors.

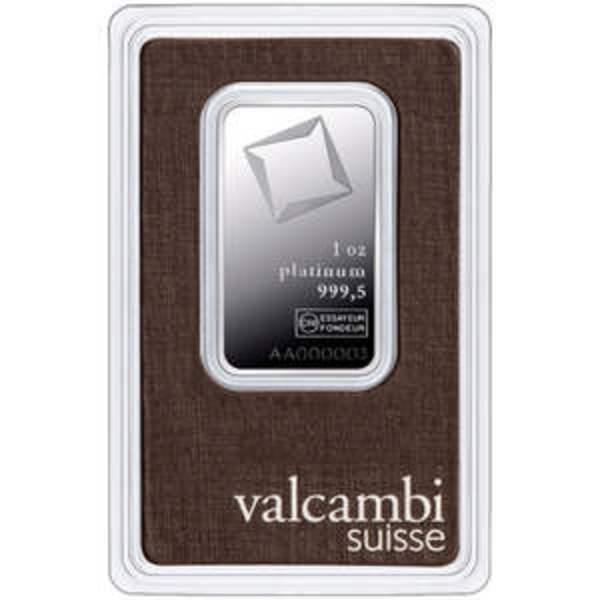

Finally, the Valcambi Platinum Bar is a favored option among platinum investors due to its quality and high purity, produced by the renowned Valcambi refinery in Switzerland.

Valcambi’s reputation for precision and high standards makes these bars highly sought after in the platinum market. They offer a reliable and valuable addition to diversified portfolios. Each of these bullion bars provides investors with security, global recognition, and a dependable means of wealth preservation.

Conclusion

Bullion bars are a practical option for investors looking to store wealth in precious metals. Their focus on weight and purity makes them an efficient way to buy, hold, and trade metals like gold and silver. Whether you prefer gold for stability or silver for affordability, starting with trusted bars like PAMP Suisse or Perth Mint ensures you have high-quality assets that are easy to sell when needed. Bullion bars remain a reliable and straightforward investment for those interested in long-term wealth preservation.