Gold has captivated civilizations for millennia, prized for its beauty, rarity, and role as a store of value. Whether in the form of jewelry, coins, or bullion bars, Gold remains a sought-after asset for investors and collectors alike. But when it comes to gold bars, many people picture the massive gold bricks stored in bank vaults, weighing dozens of pounds and worth a fortune.

In reality, gold bars come in various sizes and weights, making gold ownership accessible to small and large investors. This article explores how gold bars are valued and made and why they continue to be a hedge against inflation and economic uncertainty.

What Defines a Standard Gold Bar?

The term “standard gold bar” refers to the Good Delivery bars used in international gold trading and central bank reserves. These bars are produced to strict specifications set by the London Bullion Market Association (LBMA) and weigh 400 troy ounces (approximately 27.5 pounds). Measuring 7 inches by 3 ⅝ inches by 1 ¾ inches, these bars are the ones seen in movies and financial news reports.

However, gold bars also come in smaller sizes, making gold investment more accessible for individuals. Investors can purchase bars ranging from as small as 1 gram to as large as a kilo of gold (32.15 troy ounces). This flexibility allows anyone to own physical Gold, regardless of budget.

What Are Good Delivery Bars?

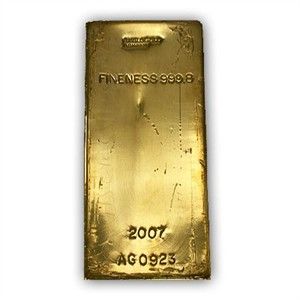

To qualify as a Good Delivery bar, a gold bar must:

✔ Weigh between 350 and 430 troy ounces

✔ Be at least 99.5% pure gold

✔ Be produced by an LBMA-accredited refiner

✔ Bear a serial number, refiner’s stamp, weight, and purity hallmark

Gold refiners meeting these strict standards ensure that gold bars are widely accepted by banks, investors, and governments worldwide.

How Much Is a Standard Gold Bar Worth?

Today, the market value of a 400-ounce Good Delivery gold bar depends on the spot price of Gold, which fluctuates based on supply, demand, and economic conditions. With gold prices averaging around $2,000 per troy ounce, a full-size gold bar would be worth approximately $800,000.

Smaller bars, such as 1-ounce or 10-ounce, are also widely traded and easier to store. For example:

- 1-ounce gold bar (~$5278.51)

- 10-ounce gold bar (~$52785.1)

- 1-kilo gold bar (~$169704.1)

These prices fluctuate based on the daily spot price of Gold.

How Are Gold Bars Made?

Gold bars undergo refining and minting to ensure purity and weight consistency. The three primary refining methods include:

- Smelting and cupellation involve heating gold with silica and borax to separate impurities. Gold’s high density allows it to sink while impurities rise and are skimmed away.

- Chemical Treatment – Using acids like hydrochloric and nitric acid to dissolve impurities and isolate pure Gold.

- Electrolytic Refining – Passing an electric current through molten Gold to separate pure Gold from other metals. This method produces Gold of the highest purity.

Once refined, the Gold is melted and poured into pre-shaped molds, resulting in gold bars of various weights.

Understanding Gold Weight and Measurement

Gold is measured in troy ounces, a unit different from the standard ounce used for other materials:

📏 1 troy ounce = 31.1 grams

📏 1 standard ounce = 28.35 grams

The troy ounce, which originated from the medieval French town of Troyes, has been the official measurement of gold since the 1400s.

Factors That Determine the Value of a Gold Bar

Several key factors determine the price of a gold bar:

1. Purity & Fineness

- Gold is measured in karats (K) or fineness.

- 24-karat Gold is pure Gold with a fineness of 999.9 (or 99.99% pure).

- Lower-karat gold (e.g., 18K, 14K) contains other metals, like copper or silver, reducing its value.

2. Size and Weight

- Larger bars generally have lower premiums over the spot price, making them a more cost-effective way to buy Gold.

- Smaller bars (e.g., 1 gram, 5 grams, 1 ounce) offer greater flexibility and liquidity.

3. Spot Price of Gold

- Gold’s value is influenced by global economic conditions, inflation, central bank policies, and supply/demand.

- The London Bullion Market Association (LBMA) sets the global benchmark for gold prices.

4. Hallmarks & Refinery Stamps

- Gold bars from LBMA-accredited refiners (e.g., PAMP Suisse, Valcambi, Credit Suisse, Perth Mint) command higher resale value.

Gold Bars as a Hedge Against Inflation

Why Is Gold a Safe Haven Investment?

Unlike fiat currency, Gold cannot be printed or manipulated by governments. Historically, Gold retains its purchasing power during inflation and financial crises.

🔹 When inflation rises, the value of paper money falls—but Gold holds steady or increases in value.

🔹 Gold has outperformed stocks and bonds during economic downturns.

🔹 During the 2008 financial crisis, Gold surged as investors sought safety.

In 2020, during the COVID-19 pandemic and massive government stimulus spending, gold prices hit record highs as investors turned to tangible assets.

Gold’s Role in Portfolio Diversification

Investing in gold bars is a proven way to diversify wealth. Financial advisors often recommend allocating 5%–15% of a portfolio to precious metals.

Gold provides:

✔ Wealth preservation

✔ Portfolio balance against stock market fluctuations

✔ Liquidity – quickly sold during economic uncertainty

Where to Buy Gold Bars?

Gold bars can be purchased from: ✅ Reputable online dealers – APMEX, JM Bullion, SD Bullion, Provident Metals

✅ Local coin shops & precious metals exchanges

✅ Banks & authorized bullion dealers

When buying gold bars, ensure:

- The dealer is trusted and accredited.

- The bar is LBMA-certified with a recognized hallmark.

- The packaging is intact and has an assay certificate.

Final Thoughts: Is Gold a Good Investment?

Gold remains one of the best long-term stores of value, maintaining its worth across centuries. Whether purchasing a 1-gram bar or a full 400-ounce Good Delivery bar, Gold is a tangible, globally recognized asset.

With inflation, economic uncertainty, and fiat currency devaluation, owning Gold protects wealth and strengthens portfolios.

Key Takeaways

✔ Gold bars come in various sizes, from 1 gram to 400 ounces.

✔ Gold holds its value during inflation and economic crises.

✔ Investors use Gold to diversify portfolios and preserve wealth.

✔ Spot prices fluctuate daily based on global market conditions.

✔ Buying from trusted sources ensures authenticity and resale value.

As governments continue printing money and inflation rises, Gold remains the ultimate safe-haven investment that has stood the test of time.

References

- U.S. Mint: Gold Bar Production & Standards – www.usmint.gov

- JM Bullion: Investing in Gold Bars – www.jmbullion.com

- World Gold Council: Gold Investment Guide – www.gold.org