Investing in precious metals is a popular strategy for diversifying portfolios and safeguarding wealth against economic fluctuations. However, newcomers and seasoned investors often encounter a perplexing question: why do they pay more than the spot price for bullion? This article delves into the factors contributing to dealer premiums over spot price, offering insights into how investors can navigate the bullion market more effectively.

What is the Spot Price?

The spot price is the current market price at which a particular precious metal can be bought or sold for immediate delivery. Determined by global supply and demand dynamics, spot prices are constantly updated in real-time and provide a benchmark for trading. However, buyers typically pay more than this spot price when purchasing physical bullion, a discrepancy attributed to premiums.

Understanding Premiums on Bullion

Premiums are the additional costs above the spot price that buyers pay when purchasing physical bullion. These premiums can vary widely depending on several factors:

- Manufacturing Costs: Transforming raw metal into refined bars or coins involves minting, design, and packaging costs.

- Distribution and Logistics: Transporting and storing precious metals require secure facilities and logistics, contributing to the overall cost.

- Dealer Markup: Dealers incorporate a profit margin to cover their business operations, such as marketing, staffing, and overhead expenses.

- Market Demand: High demand for certain products, such as popular coin series or limited-edition releases, can increase premiums.

- Economic Conditions: Geopolitical events and economic instability can influence investor behavior, impacting premiums.

How Can Investors Find the Cheapest Prices on Bullion?

Minimizing premiums is a crucial strategy for investors looking to maximize their returns on bullion investments. Here are some tips to find the best prices:

- Research Multiple Dealers: Prices can vary significantly between dealers. Comparing offers from multiple sources can help identify competitive pricing.

- Buy in Bulk: Purchasing larger quantities often comes with reduced premiums per unit, as dealers may offer discounts for bulk orders.

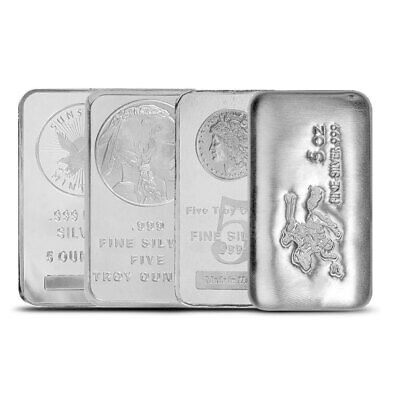

- Consider Different Forms of Bullion: Coins generally carry higher premiums than bars due to their collectible nature. Opting for bars can sometimes result in lower premiums.

- Monitor Market Trends: Staying informed about global market conditions and economic indicators can help anticipate premium fluctuations.

- Look for Sales and Promotions: Dealers occasionally offer discounts during special promotions or economic downturns.

Why Does Each Dealer Sell the Same Product for a Different Price?

The variation in pricing for the same bullion product across different dealers is influenced by several factors:

- Operating Costs: Dealers with higher operational costs may charge higher premiums to maintain profitability.

- Supply Chain Efficiency: Dealers with efficient logistics may offer lower premiums due to reduced costs in transportation and storage.

- Inventory Levels: Dealers with excess inventory might reduce premiums to clear stock, while those with limited stock may charge higher premiums.

- Brand Reputation: Established dealers with a strong market presence may charge higher premiums due to perceived reliability and customer trust.

- Geographic Location: Regional tax laws and shipping costs can result in price variations based on the dealer’s location.

Conclusion

Understanding the reasons behind premiums on bullion is crucial for making informed investment decisions. Investors can effectively navigate the precious metals market by recognizing the factors that influence these premiums and employing strategies to minimize costs. As with any investment, thorough research and due diligence are essential for optimizing returns.

For further reading on bullion premiums and market strategies, consider visiting resources like Kitco and APMEX.